Insights from the Global Gateway Webinar: Synergies with ASDT and Africa’s Reimagined Future

This article will rigorously explore the complex threats to Africa’s sovereignty, at national and pan-African levels. It will trace the progression from colonial resource plunder and debt traps to modern cyber and cognitive manipulations by foreign actors. Importantly, it will highlight how Africa’s Sovereign Development Trust (ASDT) and the upcoming Sandton Symposium provide a realistic, forward-looking strategy for true self-determination, advancing a cohesive security framework, integrated markets, and an Africa-led global presence.

I. Introduction: Charting Africa's Transformational Decade

The recent ECDPM-hosted Global Gateway webinar serves as a pivotal moment, marking the culmination of the European Union’s 15-year journey in development cooperation with Africa. This event underscores a critical juncture for both continents, signaling a profound shift towards more equitable and impactful partnerships. Africa stands at the threshold of a transformational decade, poised to redefine its role in the global economy and establish itself as a powerhouse of innovation, trade, and sustainable growth. This reimagining fosters a genuine economy, positioning Africa as a competitive global player.

The Ndege Group, Africa’s Sovereign Development Trust (ASDT), is pioneering a transformative approach to African development, headquartered in Nairobi, Kenya. Its core mission is to reshape the continent's socio-economic trajectory by fostering self-sufficiency, promoting ethical investment, and reducing traditional dependencies. ASDT champions African sovereignty as the cornerstone of liberation, advocating for self-determination and the reclamation of control over resources, ensuring Africa's destiny is shaped by its own hands.

The evolving narrative surrounding development cooperation reveals a significant shift. The Global Gateway, as articulated by the European Union, explicitly aims for “mutually beneficial partnerships” that actively engage local actors, private finance, and civil society, moving away from traditional grants towards investments for competitiveness. This strategic emphasis on quality infrastructure, coupled with adherence to high social and environmental standards, indicates a conscious effort by the EU to align with Africa's growing demand for self-determination and to address historical criticisms of conventional development assistance. This evolving approach creates a fertile ground for organisations like ASDT, which are inherently built on principles of self-sufficiency and ethical, African-led investment, to present themselves as natural and indispensable partners, rather than merely another recipient of external assistance.

Furthermore, a deeper understanding of Africa's agency in global development is crucial. The continent is actively pursuing a reimagined future where it fosters a genuine economy and positions itself as a competitive global player. This vision is not merely aspirational; it is underpinned by substantial internal capacity. Reports indicate that Africa holds over $4 trillion in mobilisable capital from institutional assets, banking sector liquidity, and sovereign reserves. African Development Finance Institutions (DFIs) have already financed over $150 billion in power, transport, housing, agribusiness, and manufacturing over the past decade. This demonstrates a robust, often overlooked, internal drive and existing financial capacity that traditional aid models have frequently failed to acknowledge or empower. Therefore, effective partnerships with Africa, such as the Global Gateway, are most successful when they acknowledge, respect, and actively empower this inherent African agency and existing financial and developmental capacity, rather than treating the continent as a passive recipient of aid. ASDT embodies this active agency and can serve as a conduit for channeling this internal strength.

II. The European Commission's Global Gateway: A New Era of Partnership

Strategic Vision and Core Principles: Beyond Traditional Aid

Launched in 2021, the Global Gateway is the European Union's ambitious new strategy designed to foster smart, clean, and secure connections across digital, energy, and transport sectors, while simultaneously strengthening health, education, and research systems worldwide. This initiative is explicitly positioned as the European Commission's contribution to narrowing the global investment gap and is fully aligned with the United Nations' Agenda 2030, its Sustainable Development Goals, and the Paris Agreement. The core principles guiding Global Gateway investments include democratic values, adherence to high standards, good governance, transparency, the promotion of equal partnerships, a focus on green and clean initiatives, security, and a strong emphasis on catalyzing the private sector. This comprehensive framework signals a stated departure from traditional, less conditional aid models, aiming instead for a more collaborative and impactful approach.

Financial Commitments and Investment Focus in Africa

The Global Gateway aims to mobilise a substantial sum of up to €300 billion in investments worldwide by 2027 through a "Team Europe" approach, which brings together the EU, its Member States, and their financial and development institutions. Africa is a central pillar of this strategy, with approximately half of this commitment, €150 billion, specifically allocated for sustainable investments on the continent. These investments are strategically directed towards critical sectors, including climate, energy, transport, and digital projects.

Specific ambitions for Africa are clearly defined. By 2030, the initiative aims to increase renewable energy generation capacity by at least an additional 300 GW and to provide at least 100 million people in Africa with access to electricity. The financing mechanisms employed by Global Gateway are diverse, encompassing grants, loans, blended finance, and guarantees, all designed to mobilize private funding. Notably, the EU's guarantee volume stands at €53 billion, which is expected to leverage up to €232 billion of sustainable investments.

Despite the ambitious stated financial commitments, a closer examination reveals a nuanced reality regarding the ‘new era’ of funding. While the Global Gateway is branded as a new strategy mobilizing up to €300 billion, evidence indicates that the EU will not be providing new funds for the targeted investment amount by 2027; instead, existing funding will be reallocated. This means the €150 billion designated for Africa represents a re-prioritization of existing budgets rather than a significant injection of fresh capital. Furthermore, reports suggest that there has been limited new funding from the private sector to date, despite its expected "important investment contribution". This suggests that while the strategic intent and framing of Global Gateway represent a shift towards investments and partnerships, the financial mechanics rely heavily on repurposing existing public budgets and attracting private capital that remains largely untapped. This creates a gap between ambition and current execution, which requires complementary mechanisms for effective capital mobilization.

Key Flagship Projects and Progress in Africa

The Global Gateway has identified a substantial portfolio of over 264 projects, with approximately half focused on climate initiatives. The Council of the EU endorsed 46 new flagship projects for 2025, adding to the 218 initiatives launched between 2023 and 2024. Consistent with its focus on Africa, half of the 2024 lighthouse projects are located on the continent.

Concrete examples of these projects underscore the breadth of the Global Gateway's engagement:

Transport: Includes the construction of a Bus Rapid Transit system in Nairobi and the development of the Lobito Corridor, a vital artery connecting the Democratic Republic of Congo and Zambia to the Atlantic Ocean.

Digital: Features the construction of optic fiber infrastructure in Kenya, the Medusa submarine optical fiber cable connecting North African countries with Europe, and the Blue Raman submarine cable stretching from Europe to India with intermediate landings in Eastern Africa, enhancing high-speed data connectivity.

Energy: Encompasses projects like the Ruzizi III hydropower plant for DRC, Rwanda, and Burundi, a high-voltage undersea electrical interconnection between Egypt and Greece, the rehabilitation of the Kariba Dam (Zambia/Zimbabwe), and various solar and hybrid power plants in Niger, alongside the Nachtigal hydropower plant in Cameroon.

Health: Focuses on manufacturing and access to vaccines, medicines, and health technology products in countries such as Senegal, Rwanda, Ghana, and South Africa.

Education and Research: Supports initiatives like the Regional Teacher Programme and the broader Africa-EU Science, Technology and Innovation Initiative, aiming to improve capacities and strengthen innovation ecosystems.

A critical analysis of the Global Gateway's strategy reveals its geopolitical underpinnings. The EU is adopting a more strategic and openly interest-led approach than in previous development initiatives. The overarching geostrategic goal of Global Gateway is to secure access to certain resources, energy sources, and markets, and to reduce dependencies, particularly on China. This indicates that while the rhetoric emphasizes equal partnerships, a strong self-interest component drives the initiative. The fact that some African politicians are reportedly relieved that Europe is at least finally honoring its interest-driven policies suggests a recognition of this underlying strategic motivation. This reframes the mutually beneficial aspect of Global Gateway: it is not solely about Africa's benefit, but also Europe's strategic need to diversify supply chains and counter rival geopolitical influences.

Table 1 above provides a concise overview of the key financial commitments and focus areas of the EU Global Gateway Africa Investment Package.

III. The Ndege Group (ASDT): Pioneering Africa's Sovereign Development

Foundational Philosophy: Fostering Self-Sufficiency and Ethical Investment

The Ndege Group, Africa's Sovereign Development Trust (ASDT), is dedicated to reshaping Africa's socio-economic trajectory by fostering self-sufficiency, promoting ethical investment, and reducing traditional dependencies. At its core, ASDT operates on several foundational tenets designed to empower the continent. It champions Africa's sovereignty as a sacred right to self-determination, engaging with African governments to break free from debt dependency and reclaim control over resources, ensuring Africa's destiny is shaped by its own hands. The organisation promotes a borderless economy to foster seamless intra-African trade and collaboration, advocating for a unified African currency as a bold step toward financial sovereignty and regional integration. Ethical governance is a bedrock principle, with a focus on transparency and accountability to replace corruption and exploitation. Furthermore, ASDT is committed to building transformative infrastructure and upholding environmental and cultural stewardship for future generations. The Trust emphasizes "principled partnerships" built on mutual respect and shared goals, ensuring collaborations empower African communities while aligning with the continent's vision for sovereignty.

The Development Finance Fund (DFF): Catalyzing Transformative Infrastructure and Economic Growth

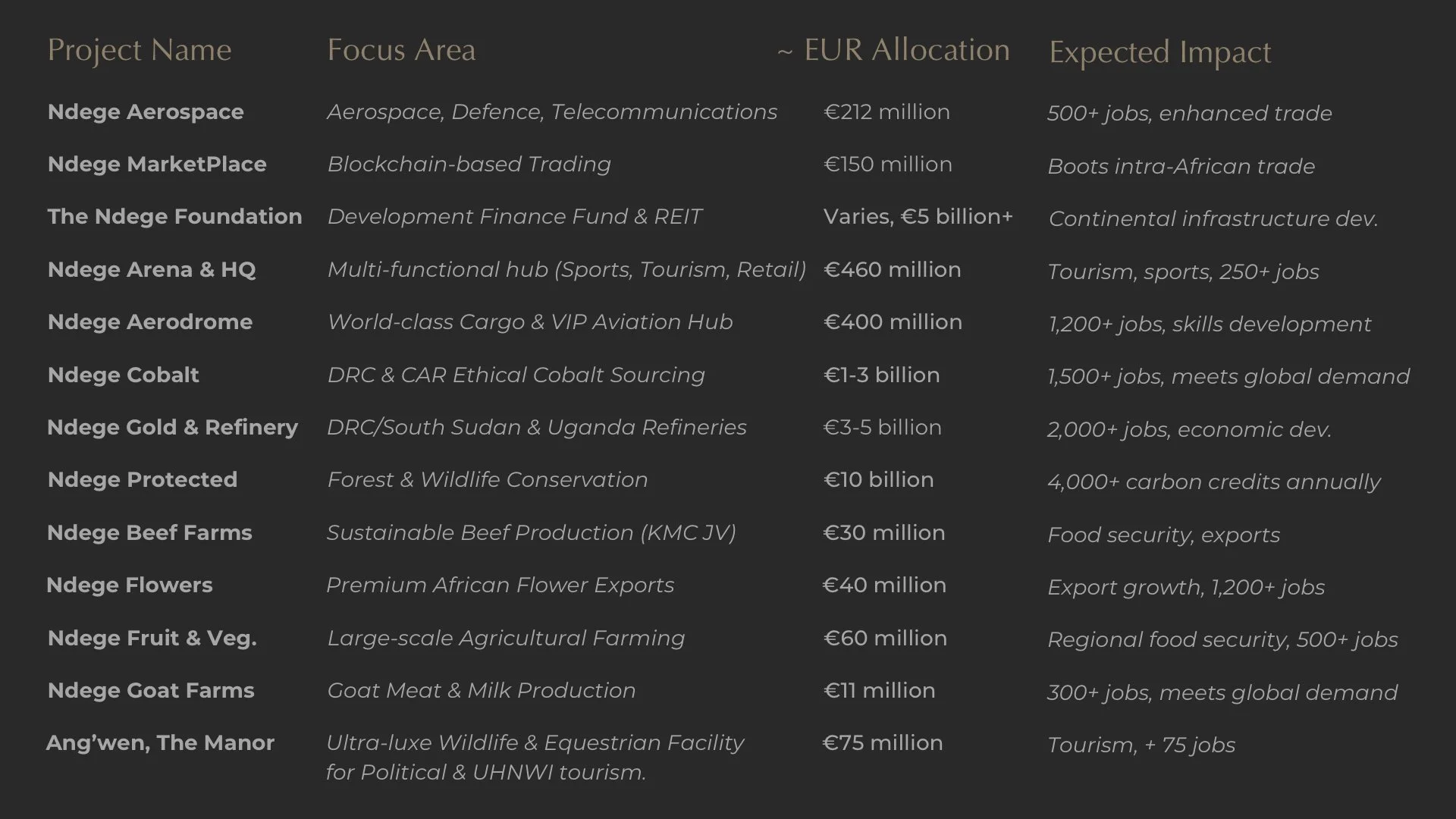

The Development Finance Fund (DFF) operates under The Ndege Foundation, a key department of The Ndege Group. Its mission is to collaborate with established funds and family offices to amplify ASDT's impact across Africa. The DFF's strategic project portfolio for 2025-2035 outlines ambitious initiatives with significant capital allocations and projected impacts:

Ndege Aerospace: Focused on aviation, aerospace, and telecommunications, with a capital allocation of €212 million, projected to create over 500 jobs and enhance trade.

Ndege MarketPlace: A blockchain-based trading platform allocated €150 million, aimed at boosting intra-African commerce and project financing.

The Ndege Foundation (DFF & REIT): Dedicated to continent-wide infrastructure development through its Development Finance Fund and Real Estate Investment Trust, with varying capital allocations based on specific project scopes.

Ndege Arena & HQ (Nairobi): A multi-functional hub with the region’s premier public aquarium in Nairobi, Kenya, with €460 million allocated, expected to drive tourism, sports, and job creation.

Ndege Aerodrome (Kenya): A world-class aerospace facility in Kenya, allocated €400 million, projected to create over 1,200 jobs and foster skills development.

Ndege Cobalt (DRC & CAR): Focuses on ethical cobalt sourcing in the Democratic Republic of Congo, with a substantial allocation of in the billions, expected to create over 1,500 jobs and meet global demand.

Ndege Gold Mines & Refinery (DRC/South Sudan/Uganda): Engaged in ethical gold mining with €500 million to €1 billion allocated each, contributing significantly to economic development and job creation.

Ndege Protected (Kenya): Dedicated to the conservation of forests and wildlife in Kenya, allocated €10 million, projected to generate 4,000 carbon credits annually.

Other significant projects include Ndege Beef Farms (€30M), Ndege Flowers (€40M), Ndege Cereals, Fruit & Veg (€60M), Ndege Goat Farms (€11M), and the Ang'wen, The Manor, Ultra-Luxury Wildlife & Equestrian Estate (€75M).

The DFF has already demonstrated tangible impact and a strong commitment to community-led development. Achievements include securing a gold mine in Uganda through a merger and acquisition exercise with Chinese investors, and syndicating $300 million for a waste-to-energy project in Rivers State, Nigeria. This latter project is a 200MW plant that transforms municipal waste into clean energy, powering thousands of homes, and supporting electric vehicle manufacturing. Beyond large-scale infrastructure, the DFF supports grassroots initiatives such as peace campaigns, greenhouse projects, feeding programs, and a scholarship initiative that has provided education to over 2,500 children in Nairobi's Kibera slum. It also maintains a focus on sanitation and healthcare projects across Africa. A seminal initiative is the United African Defence Force (UADF), conceived by ASDT’s Founder & Chairman, David Okiki Amayo Jr., to unify Africa's 54 nations under a robust defense apparatus. The UADF aims to foster enhanced regional stability, diminish reliance on external military interventions, and safeguard African sovereignty, with its establishment strategically integrated with OmniGaza to ensure transparency and accountability.

Table 2 provides a detailed overview of The Ndege Group's Development Finance Fund's key initiatives and their respective capital allocations and expected impacts.

The Ndege Group serves as a powerful catalyst for indigenous capital mobilization and diversification. Reports indicate that Africa possesses over $4 trillion in mobilizable capital from institutional assets, including pension funds, sovereign wealth funds, and insurance companies. Despite this vast internal wealth, the continent faces an annual infrastructure funding gap estimated between $68 billion and $108 billion, attracting only 2% of global investment in this critical sector. ASDT's Development Finance Fund, with its diverse project portfolio and active syndication efforts—such as the $300 million waste-to-energy project in Nigeria —directly addresses this disparity by demonstrating and facilitating the channeling and leveraging of African resources and ingenuity. This focus on unlocking and directing internal capital is crucial for genuine self-sufficiency, reducing reliance on external aid, and diversifying funding sources, positioning ASDT as a leader in Africa's financial autonomy.

OmniGaza: The Blockchain Backbone for Transparent and Sovereign Finance

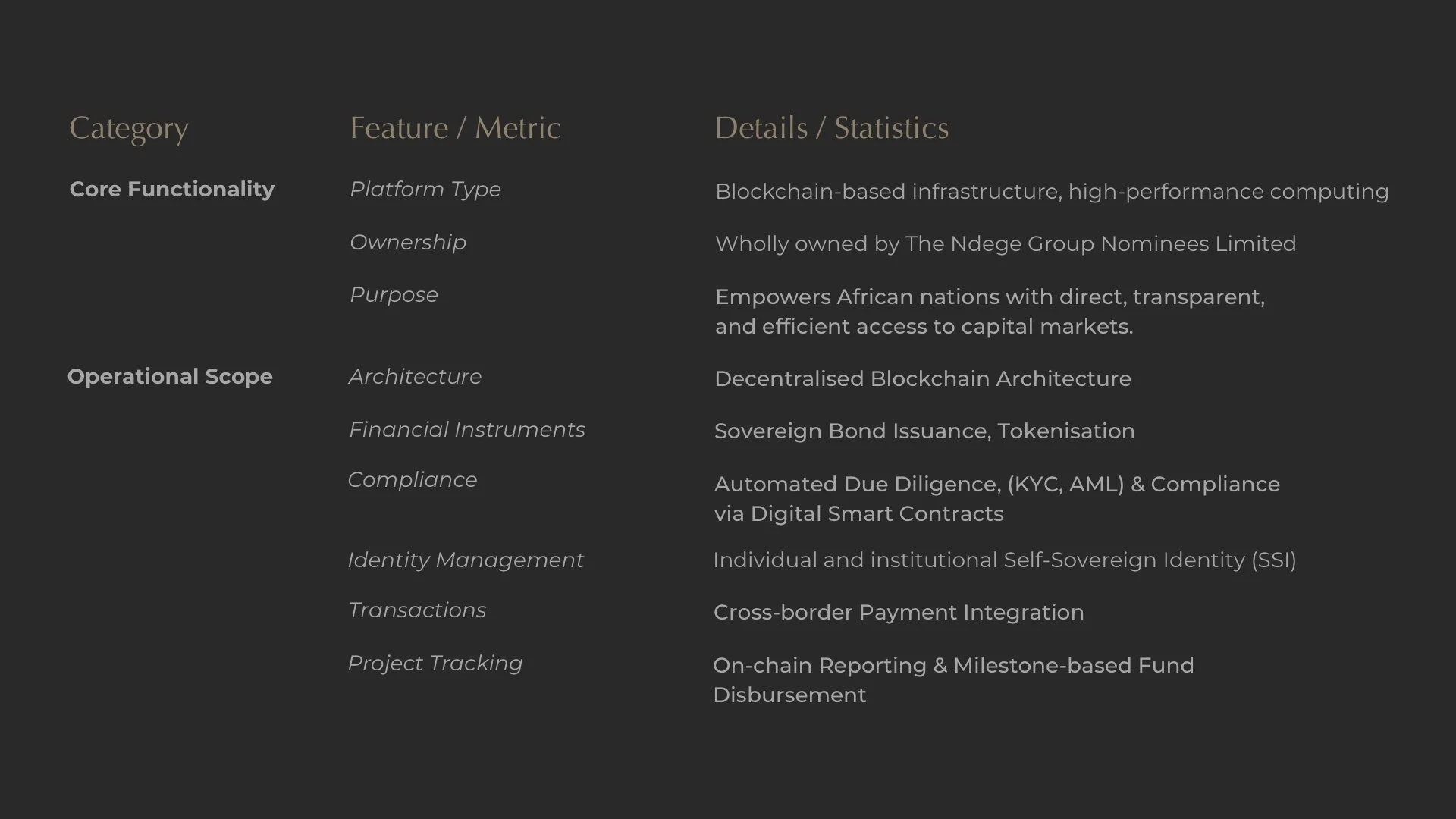

At the core of ASDT's innovative approach is OmniGaza, meaning "omniscient illumination" (from Swahili "mwangaza"). This €100 million+ high-performance computing platform is wholly owned by The Ndege Group and represents a novel, blockchain-based digital infrastructure. OmniGaza is designed to empower African nations with direct, transparent, and efficient access to capital markets, fundamentally reimagining development finance.

The platform is engineered to revolutionize capital access and significantly reduce inefficiencies. It is designed to slash transaction costs by up to 70% compared to traditional models and reduce sovereign bond issuance times from months to mere days. OmniGaza prioritizes African data sovereignty, handling everything from sovereign bond issuance to cross-border payments with immutable transparency. Its operational scope includes a decentralized blockchain architecture, robust sovereign bond issuance and tokenization capabilities, automated due diligence processes (including Know Your Customer/KYC and Anti-Money Laundering/AML), individual and institutional Self-Sovereign Identity (SSI), seamless cross-border payment integration, and verifiable on-chain reporting and fund disbursement. The platform's main purpose trust is strategically based in Seychelles, recognized as Africa's least corrupt jurisdiction (ranking 20th globally on the Corruption Perceptions Index with a score of 71/100, far surpassing the continental average of 43/100). This strategic choice reinforces OmniGaza's unwavering commitment to integrity and its mission to eradicate financial opacity.

Case studies powerfully highlight OmniGaza's transparency and anti-corruption impact. In Malawi, a €2.5 million primary school donation facilitated through OmniGaza ensured "zero leakage" with every transaction immutably recorded on the blockchain. The verifiable audit trail not only guaranteed accountability but also prompted pledges from the trustee's network for five more schools across Africa, contingent on performance metrics like student enrolment increases. Similarly, in Nigeria's Rivers State, a €276 million Waste-to-Energy project arranged by ASDT saw corruption incidents reduced by 65% once stakeholders observed the community benefits, tracked in real-time. These results stand in stark contrast to traditional aid models, where up to 30% of funds are reported lost to inefficiencies. OmniGaza's smart contracts and decentralized ledger automate compliance and have reduced corruption risks by 80% in pilot projects. The platform is projected to save African nations an estimated €9.2 billion annually in intermediary costs.

Tables 3 & 4 above summarize the key features, financial impact, and transparency metrics of the OmniGaza platform.

OmniGaza functions as a sovereign technology solution directly addressing governance and trust deficits. The user query and ASDT's mission strongly emphasize African sovereignty and ethical governance. Traditional aid models are frequently criticized for conditionalities, a lack of transparency, and susceptibility to corruption, which often results in funds not reaching intended beneficiaries and contributing to unsustainable debt burdens. OmniGaza's blockchain technology offers immutable transparency, has demonstrated zero leakage, and has achieved significant reductions in corruption risks in real-world applications. Its strategic base in Seychelles, Africa's least corrupt jurisdiction , further reinforces this commitment to integrity. This directly counters the perception of high corruption risk often associated with African investments, a perception that the Global Gateway implicitly acknowledges by aiming to de-risk investment mobilization. Therefore, OmniGaza is not merely a financial platform; it is a profound governance tool that empowers African nations to control their financial pathways with unprecedented transparency and accountability. This makes it a compelling real solution for attracting ethical investment and building trust, both internally among African stakeholders and externally with international partners like the EU. It directly addresses one of the most significant historical criticisms of traditional development finance: the leakage and misuse of funds, thereby fostering a more reliable and attractive investment environment.

IV. A Comparative Lens: Global Gateway vs. Traditional Development Models

Contrasting Approaches: EU's Mutually Beneficial Partnerships

The Global Gateway initiative marks a strategic shift for the EU, moving towards mutually beneficial partnerships that actively engage local actors, private finance, and civil society, transitioning from grants to investments for competitiveness. This approach emphasizes shared values, good governance, and transparency. The EU's stated aim is to offer a positive offer that designs sustainable, quality projects, implemented transparently, without creating unsustainable debt, and delivering lasting social and economic benefits to local communities. This represents a conscious effort to differentiate its approach from historical development models.

Critique of Conventional Aid: US Imperialist, UK Neocolonial, and China's Debt-Heavy BRI

A critical examination of traditional development models reveals inherent challenges and criticisms that the Global Gateway seeks to address:

US Imperialist Approaches: These are often characterized by security-tied aid aimed at asserting dominance. Historically, US aid, such as the 1950 Point Four Program, aimed to create markets for the US and diminish perceived threats like communism. While initiatives like the President's Emergency Plan for AIDS Relief (PEPFAR), the President's Malaria Initiative (PMI), and the Millennium Challenge Corporation (MCC) have yielded significant positive impacts, saving millions of lives and fostering partnerships, concerns persist about aid being tied to US economic interests. For instance, over $2 billion in food aid is purchased annually from American farmers, and issues have arisen when such aid is frozen, leading to waste. Furthermore, in FY2023, less than $20 billion of USAID's over $40 billion budget was allocated to Africa, with a significant 40% directed towards Europe and Eurasia, primarily Ukraine.

UK's Neocolonial Undertones: UK aid, and broader Western aid, is often associated with historical tied aid that exploited resources. Critics argue that such aid comes with "strings attached," including International Monetary Fund (IMF) loans with austerity measures that necessitate the privatization of state-funded resources and reductions in government spending. A substantial portion, estimated at 70% to 80%, of this aid is reported to cycle right back to the donor country as "overhead costs" for domestic bureaucrats, rendering it ineffective and often failing to reach target populations. This perpetuates a cycle of dependence, weakens recipient governments, and is frequently seen as stemming from a ‘white savior mindset’ and a failure to acknowledge the enduring legacies of European colonization and resource exploitation, which contributed to Africa's development challenges in the first place.

China's Belt and Road Initiative (BRI): Characterized as business-oriented and debt-heavy infrastructure. The BRI, which has been in existence for 11 years, has mobilized significantly larger funds than the Global Gateway and has established dependencies through substantial investment and control of critical raw materials. While it offers faster project implementation with less red tape due to centralized management by state-owned enterprises (SOEs) and financing by state-owned banks, it faces criticism for overreach, waste (with projects not always proving profitable or useful), and creating unsustainable debt levels for recipient nations. The EU's Global Gateway is explicitly conceived as a strategic response to the BRI.

The Global Gateway's Distinct Value Proposition: High Standards, Transparency, and Shared Values

The Global Gateway aims to differentiate itself by emphasizing democratic values, high social and environmental standards, good governance, and transparency. It explicitly seeks to avoid creating unsustainable debt for partner countries. However, the initiative faces challenges in competing with the BRI's speed and centralized efficiency, and its untied aid principles can paradoxically make projects less appealing for European businesses. Furthermore, the EU's NDICI regulation introduces explicit restrictions on who can participate in procurement, designed to protect EU companies from Chinese and other emerging country competitors. This could be interpreted as a form of tied aid, albeit for different strategic reasons, adding a layer of complexity to the EU's stated commitment to untied assistance.

The nuance of untied aid and strategic interests in EU policy is a critical aspect to consider. While the Global Gateway is lauded for moving away from "imperialist" and "neocolonial" approaches, and the EU generally adheres to untied aid principles, a closer examination reveals inherent contradictions. The NDICI regulation explicitly restricts procurement to protect EU companies from Chinese competitors, and the Global Gateway's openly interest-led approach aims to secure resources, energy, and markets, and reduce dependencies, especially on China. This creates a tension: while the EU's aid is ostensibly untied, clear strategic and economic interests shape the Global Gateway's implementation, potentially limiting its mutually beneficial ideal from a purely African perspective. This suggests that while the EU's rhetoric is more aligned with African sovereignty and partnership, the underlying mechanics still contain elements of self-interest that African partners must carefully navigate.

The efficacy of transparency in countering systemic aid criticisms is paramount. A recurring and fundamental criticism of traditional aid models (US, UK, China) is the pervasive lack of transparency, which leads to funds not reaching their intended beneficiaries, fuels corruption, and contributes to unsustainable debt burdens. The Global Gateway explicitly emphasizes "good governance and transparency" as core principles. ASDT's OmniGaza platform directly and technologically addresses this with features like immutable transparency, zero leakage, and significant reductions in corruption risks. Transparency, particularly enabled by cutting-edge blockchain technology as demonstrated by OmniGaza, emerges as a critical differentiator and a real solution to the systemic failures of past aid models. It not only builds trust among all stakeholders but also ensures accountability and efficiency, making investments more impactful and genuinely beneficial for African communities. This is where ASDT offers a tangible, verifiable improvement over traditional approaches and can significantly complement and strengthen the EU's stated transparency goals, fostering a more reliable and attractive investment climate.

Table 5 provides a comparative analysis of the Global Gateway alongside other major global development aid models.

V. Synergies Unlocked: Global Gateway and ASDT as Real Solutions

The convergence of the European Commission's Global Gateway initiative and The Ndege Group (ASDT) presents a powerful opportunity for Africa's reimagined future, offering practical, impactful solutions rooted in shared objectives and innovative mechanisms.

Alignment of Investment Priorities: Green, Digital, and Sustainable Infrastructure

Both the EU's Global Gateway and ASDT demonstrate a strong, synergistic alignment in their investment priorities, particularly concerning the green and digital transitions and sustainable infrastructure development. The Global Gateway has explicitly committed half of its projects to climate-focused initiatives and targets crucial sectors such as digital, climate/energy, and transport infrastructure. This is mirrored by ASDT's ethical investments, which similarly focus on transformative infrastructure, conservation efforts like Ndege Protected , and the foundational role of blockchain technology through OmniGaza. ASDT's extensive project portfolio includes significant capital allocations to Ndege Aerospace, Ndege MarketPlace (a blockchain-powered platform), and various renewable energy and sustainable farming projects. The $300 million waste-to-energy plant in Rivers State, Nigeria, is a prime example of this shared commitment to green and digital solutions, transforming municipal waste into clean energy and supporting electric vehicle manufacturing. Furthermore, the EU's "Africa-Europe Green Energy Initiative" aims for the deployment of at least 50 GW of new renewable electricity generation capacity and providing at least 100 million people in Africa with access to electricity by 2030 , directly aligning with ASDT's commitment to transformative infrastructure, including renewable energy.

Fostering Competitiveness and Value Chains: Empowering African Actors

The Global Gateway marks a significant shift towards mutually beneficial partnerships that actively engage local actors and private finance to enhance competitiveness [User Query]. It emphasizes improving the policy, regulatory, and business environment, developing skills, fostering innovation, and facilitating technology transfer. This approach finds a natural partner in ASDT, which actively promotes competitiveness through its initiatives. Ndege MarketPlace, a blockchain-powered trading platform, is specifically designed to boost intra-African trade and empower local economies. ASDT's owner-operating farms and mines also ensure fair production and trading practices, contributing to robust value chains. Both initiatives, therefore, support the development of resilient value chains and stakeholder approaches, which are crucial for Africa's economic transformation and its deeper integration into global markets.

Championing African Sovereignty and Integration: Echoing AfCFTA's Vision

A central and powerful synergy between the Global Gateway and ASDT lies in their shared, albeit distinct, commitment to African sovereignty. While the Global Gateway emphasizes equal partnerships and adherence to rule of law and human rights, ASDT explicitly champions Africa's sovereignty as a sacred right to self-determination, engaging with African governments to break debt dependency and reclaim control over resources. This alignment extends profoundly to regional integration, echoing the vision of the African Continental Free Trade Area (AfCFTA) for green, digital growth. ASDT's visionary pursuit of a borderless economy and a unified border and a unified currency directly supports this continental integration, fostering seamless trade and financial independence. The establishment of the United African Defence Force (UADF) by ASDT further underscores the commitment to regional stability and diminishing reliance on external military interventions, thereby safeguarding African sovereignty and creating a secure environment essential for sustainable development.

The Development Finance Fund and OmniGaza: Practical Mechanisms for a New Partnership Era

ASDT's Development Finance Fund (DFF) provides a robust framework for ethical, impactful investments, demonstrated by its diverse project portfolio and community-level initiatives. It directly contributes to addressing Africa's significant infrastructure funding gap, which is estimated at between $68 billion and $108 billion annually. OmniGaza, as a blockchain-based digital infrastructure, offers unparalleled transparency and efficiency, directly addressing the critical need for accountability and trust in development finance. Its proven ability to slash transaction costs by up to 70%, reduce bond issuance times from months to days, and mitigate corruption risks makes it a vital tool for attracting and managing ethical investments. These platforms present themselves as real, actionable solutions to the "new era" of development, offering a transparent, African-led, and efficient pathway for capital mobilization and project implementation, directly complementing and enhancing the Global Gateway's objectives.

ASDT is positioned as a critical catalyst for the Global Gateway's success in engaging "local actors" and mobilizing "private finance" in Africa. The Global Gateway explicitly aims for these objectives , yet current reports indicate a struggle in effectively mobilizing the expected private funding. ASDT, as an established African-led entity with a substantial Development Finance Fund and a cutting-edge platform like OmniGaza designed to streamline private capital access and reduce perceived risks , perfectly embodies both the "local actor" and "private finance" mobilization aspects that the EU seeks. ASDT's active syndication of projects, such as the $300 million waste-to-energy initiative in Nigeria , demonstrates its proven capacity to attract and deploy capital. This positions ASDT not just as an aligned partner, but as a critical enabler for the Global Gateway's success in Africa. By actively partnering with ASDT, the EU can more effectively realize its goals of private sector engagement and genuine local ownership, thereby overcoming existing challenges in capital mobilization and efficient project implementation. ASDT provides the on-the-ground expertise and trusted mechanisms that the broader "Team Europe" approach needs to thrive.

Furthermore, OmniGaza emerges as a foundational solution to the de-risking challenge and a blueprint for global transparency. The Global Gateway explicitly aims to "de-risk investment mobilisation in Africa" through financial guarantees and blended finance, implicitly acknowledging the perception of high investment risks on the continent. OmniGaza's demonstrated ability to reduce corruption risks by 80% in pilot projects and ensure zero leakage in real-world applications directly addresses this fundamental challenge. The strategic choice of Seychelles, Africa's least corrupt jurisdiction, as OmniGaza's base further reinforces its commitment to integrity. This technological solution to governance issues significantly lowers the actual and perceived risk for investors. OmniGaza offers a tangible, technological solution to the systemic governance and transparency issues that have historically plagued development finance, thereby making African investments inherently less risky and more attractive to international capital. This not only directly benefits the EU's Global Gateway by facilitating its de-risking objectives but also sets a new global standard for ethical and transparent development finance, positioning Africa as a leader in innovative solutions for financial integrity.

VI. Conclusion: Building a Prosperous and Sovereign Africa Together

The Global Gateway represents a significant evolution in the European Union's approach to development cooperation, aligning with Africa's profound aspirations for self-determination and sustainable growth. Its emphasis on investment over grants, mutual benefit, and adherence to high standards provides a robust framework for a new era of partnership between the continents. The Ndege Group (ASDT), through its robust Development Finance Fund and the groundbreaking OmniGaza platform, offers concrete, African-led solutions that perfectly complement and significantly enhance the Global Gateway's ambitious objectives. ASDT's unwavering commitment to African sovereignty, ethical investment, and transparent finance directly addresses the systemic shortcomings of past aid models and the challenges facing current international initiatives.

The synergies between Global Gateway's strategic focus on green and digital transitions, critical infrastructure development, and private sector engagement, and ASDT's deep, practical commitment to these same areas, are profound and mutually reinforcing. OmniGaza's proven ability to ensure immutable transparency and drastically reduce corruption risks is a game-changer, fostering unprecedented investor confidence and ensuring that mobilized capital directly and efficiently benefits African communities.

The collaboration between the European Commission, through its Global Gateway, and The Ndege Group can serve as a powerful, pioneering model for how international cooperation can truly empower African nations to chart their own course, free from historical dependencies. This reimagined future for Africa is not merely aspirational but is actively being built through strategic, principled partnerships that prioritize African agency. The detailed analysis of Global Gateway's strategic interests and the criticisms of US, UK, and China aid highlight the historical and ongoing challenges to Africa's vision of self-determination. ASDT's Development Finance Fund and OmniGaza, with their focus on mobilizing indigenous capital, ensuring transparent governance, and spearheading African-led initiatives such as the United African Defence Force, provide a tangible blueprint for how "Africa on its own terms" can be realized in a complex, globalized world. This blueprint emphasizes self-reliance while strategically engaging with external partners. The EU-ASDT synergy is not just about financial flows or project implementation, but fundamentally about co-creating a new paradigm for development where African agency, transparency, and self-determination are paramount. This partnership can set a powerful precedent for truly equitable global engagement, demonstrating that external support is most effective when it empowers and aligns with Africa's intrinsic drive for sovereignty.

The long-term success and sustainability of any development initiative hinge critically on trust and accountability among all stakeholders. The pervasive historical criticisms of traditional aid often stem directly from a profound lack of both, leading to inefficiencies, corruption, and a breakdown of confidence. While the Global Gateway explicitly aims for "good governance and transparency" , OmniGaza's core value proposition is built precisely on delivering immutable transparency and verifiable corruption reduction through blockchain technology. The real solutions offered by ASDT, particularly through the innovative OmniGaza platform, are fundamentally about restoring and building trust in development finance. This trust, built on verifiable transparency and robust accountability mechanisms, is the indispensable bedrock upon which sustainable, impactful, and truly sovereign African development can be achieved. This makes the partnership with Global Gateway not just synergistic but transformative, as it addresses the deepest systemic barriers to effective development. By leveraging the Global Gateway's substantial financial commitment and strategic intent with ASDT's innovative, transparent, and African-led mechanisms, a future where Africa is a truly competitive global player, thriving on its own terms, becomes an achievable and imminent reality. This demands a collective commitment to move beyond traditional paradigms, embracing genuine, equitable, and impactful collaboration as the cornerstone of sustainable global development.

Shape Africa’s Future with Us.

The time for action is now. To strengthen Africa’s sovereignty, we call on leaders, defense forces, financial institutions, and committed global partners to unite. We invite Heads of African Military Forces, Ministers of Defence and Security, and Senior Officials from African Union Peace and Security Organs to The Sandton Symposium 2025. Invitations are being hand-delivered to each African army; external allies may attend as guests of supported forces. Please register by September 1, 2025.

Detailed symposium agenda available here.

Investors aligned with ASDT’s ethical development vision: Engage via our KYC form, supporting AML/CFT standards for transparent, impactful capital flows.

Join us in Sandton for Africa’s pivotal transformation.