Architecting Africa's Future: How Integrated Value Chains Are Delivering a New Paradigm of Trust, Transparency, and Growth

Introduction: Beyond Potential—ASDT’s Impactful Action

For decades, the narrative surrounding Africa's economic development has been anchored to a single, pervasive theme: that of "untapped potential." This phrase, while optimistic, has inadvertently framed the continent as a passive landscape of latent opportunity, perpetually on the verge of a breakthrough that remains just over the horizon. This perspective, however, misdiagnoses the fundamental challenge. The primary impediment to Africa's growth is not a lack of resources, ambition, or human capital; it is the crippling effect of systemic friction. The continent's economic arteries are constricted by fragmented value chains, opaque financial and operational processes, and a pervasive deficit of trust that has turned vast swathes of its development landscape into a "graveyard of numerous development projects". These are not isolated issues but symptoms of a deep-seated structural inadequacy.

It is from this clear-eyed diagnosis that a new class of entity has emerged: Africa’s Sovereign Development Trust® (ASDT), The Ndege Group. ASDT is not merely another participant in the development sphere; it is an architect of entire ecosystems, engineered from first principles to resolve these foundational, structural impediments. The approach is a radical departure from the piecemeal interventions of the past, which have often failed to address the interconnected nature of the continent's challenges. Instead, ASDT has pioneered a holistic, integrated, and technology-driven blueprint for sustainable, African-led growth.

This report will demonstrate that by seamlessly integrating the ownership of physical assets, a proprietary blockchain-based digital marketplace, and a cohesive, world-class logistics network, all underpinned by the radical transparency of the OmniGaza platform, ASDT is creating the continent's first truly reliable, visible, and streamlined end-to-end value chains. This is not a theoretical model but a functioning architecture for execution. It is a system designed to replace ambiguity with certainty, fragmentation with cohesion, and opacity with immutable proof. In doing so, ASDT is moving the conversation beyond potential and delivering a definitive blueprint for action, forging a new paradigm of trust, transparency, and growth for Africa in the 21st century.

1. The African Value Chain Paradox: A Legacy of Fragmentation and Opacity

To construct a viable future, one must first deconstruct the failures of the past. The economic landscape of Africa is replete with paradoxes: a continent with vast arable land is a net food importer; a region rich in critical minerals often sees little of the resulting value returned to its people. These paradoxes are not matters of fate but the direct consequences of deeply flawed value chain structures. The analysis of these broken systems in both agriculture and mining reveals a common pathology of fragmentation, opacity, and a systemic lack of trust that has historically crippled development and deterred sustainable investment.

1.1. From Farm to Port: The Broken Links in Africa’s Agricultural Supply Chain.

Africa’s agricultural sector, the primary source of livelihood for over half its population, is a case study in systemic inefficiency. The continent currently imports over $50 billion in food annually, a figure that stands in stark contrast to the fact that it simultaneously loses between 30% and 50% of its harvests post-production. These post-harvest losses amount to a staggering economic drain of more than $4 billion each year—value that simply vanishes between the farm gate and the consumer. This is not a failure of production but a catastrophic failure of logistics, finance, and information flow.

The critical breakdown occurs in what are known as the "first and middle miles"—the journey from the farm to a storage facility or initial processing centre. It is within this crucial, yet chronically neglected, segment of the supply chain that over half of all agricultural losses in Sub-Saharan Africa occur. The continent's 50 million smallholder farms, which form the bedrock of the agricultural economy, are particularly vulnerable. These farmers are typically reliant on a disorganised patchwork of local, informal hauliers. A single harvest may be handed off multiple times between different transporters, with no single entity taking responsibility for its integrity. This fragmentation inevitably leads to cumulative delays, spoilage, and a silent attrition of value.

This logistical chaos is inextricably linked to a profound financial exclusion. The very structure of the agricultural value chain creates a vicious cycle that traps farmers in poverty. Because the logistics are fragmented and transparency is non-existent, farmers cannot reliably guarantee the quality or timely delivery of their produce to market. This high level of perceived risk makes traditional financial institutions deeply reluctant to provide credit. The "liquidity constraints" and "limited access to capital" that plague smallholders are a direct result of this systemic unreliability. Without access to finance, farmers cannot invest in the very things that would break the cycle: better on-farm storage to prevent spoilage, higher-quality inputs to improve yields, or dedicated transport to ensure market access. They are left with no bargaining power, weak market linkages, and an "information imbalance" that allows various intermediaries to capture the lion's share of the value, leaving the primary producers with meagre returns. This is not a series of unfortunate, isolated problems; it is a self-reinforcing system of inefficiency and poverty, a structural trap that only a complete re-engineering of the entire value chain can hope to dismantle.

1.2. From Bedrock to Bullion: The Governance Deficit in the Extractive Sector.

The extractive sector, a cornerstone of many African economies and a critical supplier of minerals for the global energy transition, suffers from a parallel, and equally damaging, set of systemic flaws. The promise of mineral wealth is consistently undermined by a profound governance deficit that manifests across the value chain. At the most basic level, operations are hampered by persistent infrastructure deficits. A lack of reliable transportation networks, power grids, and water infrastructure creates immense logistical hurdles, causing project delays and dramatically escalating operational costs.

Layered on top of these physical challenges is a climate of regulatory and political uncertainty. Fluctuating policies, unpredictable governance, and the ever-present risk of political instability deter the kind of long-term, capital-intensive investment that the sector desperately needs to modernise and grow. This environment of uncertainty is fertile ground for the governance and corruption risks that have given rise to the "Resource Curse" narrative. The fragmented and geographically dispersed nature of mineral value chains creates multiple points of failure and opportunities for illicit activity. Smuggling, opaque commodity trading deals, illicit financial flows, and corrupt licensing processes are rife, siphoning value away from national treasuries and local communities. Historically, the benefits of mining have accrued to colonial powers or foreign corporations, while local communities have been left to bear the environmental and social costs—from water depletion to habitat destruction—without adequate compensation or participation in the rewards.

Ultimately, the constellation of risks—physical, political, and ethical—converges into a single, overwhelming barrier to progress: a profound and multi-layered trust deficit. International investors, faced with regulatory ambiguity and political volatility, are naturally hesitant to commit the vast sums required for modern mining operations. An estimated EUR 1.5 trillion in investment is needed over the next 15 years simply to supply the minerals for renewable energy technologies, a figure that seems unattainable in the current risk environment. Concurrently, local communities, scarred by a legacy of exploitation and environmental degradation, remain deeply distrustful of new projects. Governments, for their part, struggle to secure their rightful share of revenues in a system characterised by opaque tax structuring and illicit financial flows. This comprehensive breakdown of trust among all key stakeholders is the single greatest impediment to unlocking the sector's potential. Any viable solution, therefore, cannot simply be about building a new road or a new mine; it must be about building a new foundation of verifiable, immutable trust.

1.3. The Consequence: A Landscape of Failed Projects

The direct and predictable consequence of these dysfunctional value chains is a continental landscape littered with the remnants of failed development projects. The high rate of project abandonment is not an anomaly but a systemic outcome. Extensive studies across the continent, from Ghana and Nigeria to Cameroon, consistently pinpoint the same root causes: endemic corruption, chronic payment delays to contractors, abysmal stakeholder management, and a fundamental lack of transparency in execution. In Sub-Saharan Africa, it is estimated that a staggering 25% of government projects are never completed, consuming vast resources with no discernible return.

Many of these failures can be traced to a flawed project design philosophy. Well-intentioned international donors and organisations often arrive with inflexible, "one-size-fits-all" models that are imposed upon local contexts without genuine consultation or adaptation. This approach invariably sidelines the very communities the projects are intended to serve, leading to a critical lack of local buy-in. When people feel disconnected from a project and its objectives, it is almost certain to fail. The case of the Lekki Toll Road Concession Project in Lagos, Nigeria, serves as a stark example. A failure to effectively engage stakeholders and manage their needs and expectations during the early phases of the project led directly to widespread public resistance and refusal by motorists to pay the tolls, undermining the project's financial viability. Similarly, a water project in Mozambique by PlayPumps International failed spectacularly because the community was never consulted; their existing, functional water pumps were replaced without their consent by a new technology that proved to be impractical and reliant on child labour, eventually falling into disuse.

These project failures are not merely isolated instances of poor management. They are the inevitable symptoms of the disintegrated systems that define the continent's economic landscape. A project that must rely on a broken and unpredictable logistics network is already at risk. A project funded through opaque financial mechanisms is vulnerable to corruption and delays. A project that fails to communicate with and incorporate the needs of its stakeholders is built on a foundation of sand. The "disconnectedness" that causes a local community to reject a new water pump is the very same systemic disconnection that leads to 50% of a farmer's harvest rotting before it can reach a market. Success cannot be bolted onto a broken system. True, sustainable success must be an emergent property of a healthy, integrated, and transparent ecosystem—the very ecosystem ASDT has been architected to create.

2. The ASDT Architecture: A Vertically Integrated Ecosystem for the 21st Century

In direct response to the systemic fragmentation and opacity that has long hindered African development, Africa’s Sovereign Development Trust® has engineered a fundamentally different approach. The ASDT model is not an incremental improvement on existing systems but a complete re-architecting of the value chain itself. It is a vertically integrated ecosystem designed to internalise control, guarantee quality, and ensure reliability from the point of origin to the final global client. This architecture, comprising direct asset ownership and a seamless network of digital and physical logistics, provides the structural antidote to the legacy of failure.

2.1. The Power of Ownership: Securing the Value Chain from the Source

The foundational principle of the ASDT model is direct ownership and operation of its core productive assets: its farms and mines. This strategy of vertical integration is not merely a matter of corporate structure; it is a strategic imperative in an environment where external market mechanisms cannot be trusted to deliver quality, reliability, or ethical conduct. This approach is validated by the enduring success of Africa's most formidable industrial conglomerates. Dangote Industries Limited, for instance, has built its empire on a bedrock of localized production and meticulously controlled, simplified supply chains, which allows it to ensure product quality and insulate itself from external disruptions.

The critical importance of this control is vividly illustrated by case studies from the agribusiness sector. Tomato Jos, a Nigerian tomato paste producer, provides a powerful lesson in strategic patience and vertical integration. Recognising that the primary constraint in the Nigerian market was not processing capacity but a consistent supply of high-quality raw materials, the company dedicated five years to perfecting its own farming operations and building a dependable network of out-grower farmers. Only after it had secured this supply chain did it invest in building its factory. This foresight stands in stark contrast to competitors who built processing plants first, assuming they could simply buy tomatoes on the open market, only to find themselves unable to source sufficient raw materials at a viable price. Similarly, Victory Farms, a leading tilapia producer in Kenya, was forced to bring its refrigerated logistics network in-house. The company found that third-party drivers would turn off refrigeration units mid-journey to save fuel, resulting in catastrophic spoilage. The only way to guarantee the integrity of its product was to own and control the cold chain itself.

These examples reveal a crucial truth about operating in many African markets. Vertical integration is not simply a strategy for capturing more margin or achieving economies of scale; it is a fundamental risk mitigation strategy. It is the process of internalising the trust and quality control that the external market ecosystem cannot reliably provide. In developed economies, companies can often build their businesses on a dependable network of third-party suppliers, logistics providers, and service partners. The evidence from Africa demonstrates that this is a dangerously flawed assumption. By owning its assets from the source, ASDT is not merely participating in the value chain; it is underwriting its integrity at every step. This provides an absolute, verifiable assurance of quality, ethical standards, and operational reliability that is simply unattainable in a fragmented, trust-deficient system.

2.2. Ndege MarketPlace & Ndege Aerospace: The Digital and Physical Arteries of Modern African Trade

Complementing its direct ownership of assets, ASDT has constructed the two essential conduits for modern commerce: Ndege MarketPlace, a proprietary digital nexus, and Ndege Aerospace, a cohesive physical logistics network. Together, they form the integrated arteries through which value flows, unimpeded by the blockages of traditional African trade.

Ndege MarketPlace is built upon blockchain technology, a distributed ledger system that creates a secure, transparent, and tamper-proof record of every transaction. This directly confronts the information imbalance that has long plagued African markets, where a lack of transparent pricing and transaction data leads to market failure and allows intermediaries to exploit producers. By creating a single, shared source of truth, the MarketPlace ensures that all parties—from the farmhand to the international buyer—are operating with the same verified information, fostering a new level of trust and efficiency.

This digital backbone is seamlessly integrated with Ndege Aerospace, the physical logistics arm of the ecosystem. Recognising that over 90% of freight in Africa is handled by a fragmented web of small-scale, informal operators, ASDT has built is operations on a network that includes reputable global storage and transportation giants such as MySafe Dubai, G4S, Network Aviation Group ✈️, National Airlines, AeroLogic, UPS and Emirates SkyCargo, aiming for full interline agreements and strategic partnerships under the Ndege Aerospace brand. This provides the sophisticated, reliable, and technologically advanced logistics capability required to solve the critical "first and middle mile" problem, where the majority of value is lost in traditional supply chains. It also provides the expertise needed to navigate the continent's complex and often deficient infrastructural landscape.

The true power of the ASDT architecture lies in the symbiotic relationship between these digital and physical layers. The research is unequivocal: physical infrastructure on its own is insufficient. It must be paired with robust digital systems that enable coordination, visibility, and data-driven decision-making. A state-of-the-art refrigerated truck operated by a Ndege Aerospace partner is only as effective as the data that guides its journey. Ndege MarketPlace provides this essential data layer. A confirmed sale of produce on the MarketPlace can automatically trigger a logistics order for Ndege Aerospace. Real-time tracking data from the vehicle can then be fed back into the platform, providing all stakeholders with end-to-end visibility. This creates a powerful, closed-loop system where the digital transaction layer and the physical movement layer are perfectly synchronised. This seamless integration eliminates the fragmentation, delays, information gaps, and value attrition that define and disable traditional African supply chains. It is a level of cohesive execution that standalone logistics firms or disconnected digital platforms, by their very nature, cannot hope to achieve. African value chains need just that—embedded value.

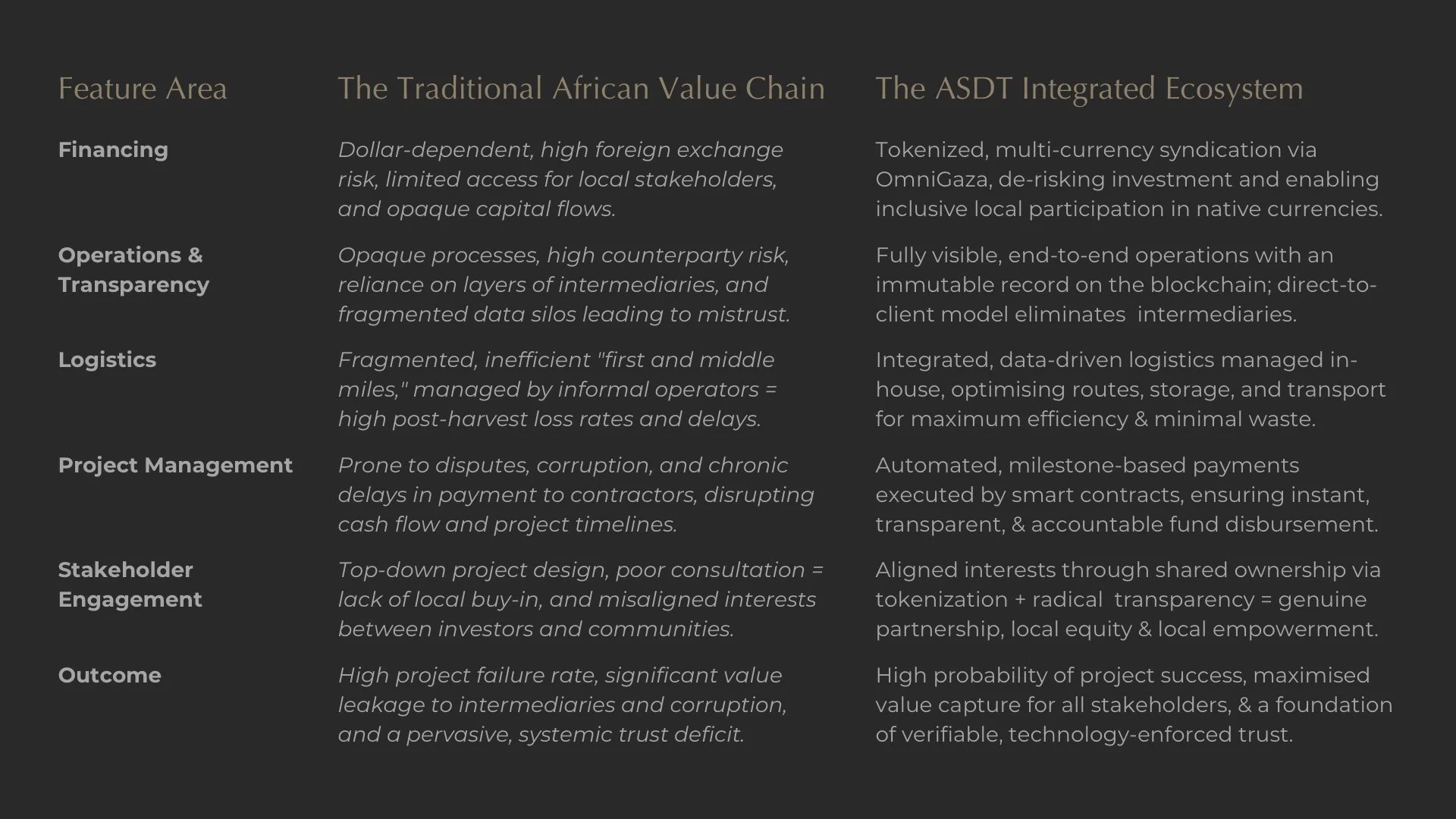

The ASDT Paradigm Shift: From Fragmented Chains to Integrated Ecosystems

3. OmniGaza: The Technological Cornerstone of Trust and Execution

At the heart of the ASDT ecosystem is OmniGaza, a proprietary technology platform that serves as the system's central nervous system. Its name is a deliberate portmanteau, combining the Latin 'Omni' (all) with the Swahili word 'Mwangaza' (light or illumination). It is, in essence, the "all-seeing light," a name that perfectly encapsulates its function: to bring absolute, verifiable transparency to every facet of the value chain, illuminating processes that have historically been shrouded in darkness and opacity. OmniGaza is more than a software platform; it is the technological cornerstone upon which ASDT's new paradigm of trust and execution is built. It integrates four revolutionary capabilities—radical transparency, tokenized finance, automated accountability, and unified intelligence—to create a system that is self-regulating, self-verifying, and inherently trustworthy.

3.1. Mwangaza—Illuminating the Path from Origin to Investor

The primary function of OmniGaza is to provide radical, end-to-end transparency, acting as the "all-seeing eye" that gives investors, clients, and partners a virtual, real-time presence on the ground. This is achieved through the deep integration of two key technologies: the Internet of Things (IoT) and blockchain. Across every ASDT operation, a network of IoT sensors is deployed to capture critical data at its source. In agricultural settings, these sensors continuously monitor vital parameters such as soil moisture content, pH levels, water usage for irrigation, and ambient climate conditions, enabling precision agriculture and resource optimisation. In the mining sector, the IoT network is even more extensive, encompassing vehicle telemetry for haulage fleets, real-time tracking of personnel to enhance health and safety, monitoring of drilling performance, and constant surveillance of crucial environmental factors, including water quality and the structural integrity of tailings storage facilities.

All of this granular, real-time data is streamed directly to the OmniGaza platform, where it is recorded on a distributed blockchain ledger. This is the critical step that transforms raw data into an unimpeachable record of fact. Because blockchain data is cryptographically secured and distributed across a network of computers, it is immutable—it cannot be altered, deleted, or tampered with by any single party. This creates a permanent, chronologically ordered, and fully auditable record of every event and transaction within the value chain. It establishes a single, shared source of truth that is accessible to all permissioned stakeholders, directly addressing the lack of transparency that has historically undermined consumer trust in product quality and eroded investor confidence in operational integrity.

The true innovation of OmniGaza, however, is not merely in its capacity for data collection, but in its ability to transform that data into a verifiable, and therefore immensely valuable, asset. It fundamentally changes the nature of corporate claims. A traditional mining company can claim its gold is ethically sourced through a glossy annual report. Through OmniGaza, ASDT can prove it, providing any stakeholder—from a compliance officer at a central bank to an end consumer—with an immutable data trail that traces the gold from the mine (verifying worker safety conditions via IoT sensor data ) through the refinery and into the client's vault. A conventional agribusiness can claim it uses sustainable irrigation practices. ASDT can prove it with a verifiable, time-stamped record of real-time water consumption data from its farms. This capability shifts the paradigm from one of corporate storytelling to one of immutable, auditable proof of performance. This level of verifiable proof is precisely what premier global stakeholders, such as institutional investors like BlackRock, are increasingly demanding as part of their due diligence. It is also the kind of verified provenance for which conscientious global consumers are willing to pay a significant premium. In effect, OmniGaza has engineered a system that monetises trust.

3.2. Tokenised Syndication: De-risking and De-dollarising African Investment

OmniGaza's architecture directly confronts one of the most significant barriers to large-scale investment in Africa: financial risk, particularly the volatility associated with foreign exchange (FX). Major infrastructure and development projects on the continent are typically financed in hard currencies, predominantly the US dollar. However, they generate revenues in local currencies. This creates a severe vulnerability; a sharp depreciation in the local currency can dramatically increase the cost of servicing dollar-denominated debt, potentially rendering an otherwise viable project unprofitable or even insolvent. This persistent risk has fueled a strong and growing policy push across the continent towards "de-dollarisation" and the promotion of intra-African trade in the Euro, Yuan and local currencies.

OmniGaza’s tokenized finance syndication model offers a powerful, market-driven solution to this challenge. The platform leverages blockchain technology to create a digital representation of ownership in a physical asset, such as a mine or a large-scale farm. This process, known as tokenization, allows ASDT to "fractionalize" a large, illiquid asset into a vast number of smaller, liquid digital tokens. These tokens, which represent a direct ownership stake in the underlying project, can then be offered to a much broader and more diverse pool of investors. This model dramatically lowers the minimum investment size, breaking down the high capital barriers that have traditionally excluded smaller investors from participating in major infrastructure projects.

Crucially, this model allows stakeholders—including local communities, domestic pension funds, and individual African investors—to purchase these tokens and hold their stake in their own local currencies. This feature fundamentally re-engineers the risk equation of African investment. The traditional financing model creates a dangerous misalignment of risk, where foreign investors bear the full brunt of currency volatility and, in turn, demand higher returns or costly hedging instruments to compensate. OmniGaza's tokenization model transforms this dynamic. When a local stakeholder invests in a project using their own currency, they become a co-owner who is naturally hedged against local currency fluctuations. Their investment and potential returns are denominated in the same currency as the project's revenues. This creates a powerful and organic alignment of interests between ASDT, its international capital partners, and the local community. Local stakeholders are no longer passive bystanders or mere recipients of development aid; they are vested partners in the project's success. This transforms the financing process from a purely extractive, high-risk transaction into a collaborative, risk-sharing partnership, fostering a far more stable, resilient, and equitable investment environment.

3.3. Automating Accountability: Smart Contracts and Milestone-Based Management

A persistent plague on development projects across Africa is the inefficiency and opacity of payment systems. Delayed payments to contractors, subcontractors, and suppliers are a primary cause of project failure, leading to crippling cash flow disruptions, work stoppages, and costly disputes that can derail even the most well-conceived plans. The OmniGaza platform is designed to eliminate this systemic friction through the use of smart contracts.

A smart contract is not a legal document in the traditional sense; it is a self-executing digital protocol with the terms of an agreement written directly into its code and stored on the blockchain. For ASDT's project managers and their partners, this technology enables a revolutionary approach to project and payment management. Key project milestones, deliverables, and payment schedules are encoded into a smart contract at the outset of a project. The contract is then linked to verifiable data inputs from the OmniGaza platform. When a predefined condition is met—for example, when IoT sensors confirm that a specific phase of construction is complete, or when a project supervisor provides a secure digital sign-off on a completed task—the smart contract automatically executes the next step in the process. Most importantly, it can trigger an immediate and automatic payment from ASDT's pre-funded trust and management accounts directly to the contractor's digital wallet or bank account.

This process is instantaneous, transparent, and removes the need for manual invoicing, lengthy approval chains, and third-party intermediaries. It creates exceptionally clear and unambiguous expectations for all parties regarding deliverables, timelines, and the speed of payment. If the blockchain ledger provides the immutable record of "what happened," the smart contract provides the automated execution of "what happens next." This transforms the entire contractual relationship. It moves from a model based on manual processing and adversarial enforcement to one founded on automated compliance and mutual accountability. The chronic problem of "payment delays" is not merely a financial inconvenience; it represents a fundamental breakdown of trust and a major source of project risk. By making the payment process deterministic, impartial, and lightning-fast, smart contracts solve this problem at its root. This dramatically reduces administrative friction and the likelihood of disputes, freeing project managers and contractors to focus on execution rather than on chasing invoices and navigating bureaucracy. It is a system that hard-codes accountability into the operational fabric of every single project.

3.4. An Integrated Intelligence Hub

The vast streams of data flowing into the OmniGaza platform are not isolated or siloed; they converge to create a unified, real-time intelligence picture that drives efficiency and security across the entire ASDT ecosystem. The value of this integrated data compounds, creating cross-divisional synergies that are impossible to achieve in a fragmented operational environment.

For Ndege Aerospace, the logistics division, OmniGaza acts as a powerful predictive planning tool. Real-time data on crop harvesting schedules or mineral extraction rates allows the logistics team to optimise its operations with unparalleled precision. Transport and storage capacity can be pre-allocated to exactly where it will be needed, reducing waste, lowering costs, and preventing the bottlenecks that lead to spoilage and delays. This data-driven approach mirrors the success of cutting-edge logistics platforms like Haul247 (Google BFF’AFRICA 22), which have demonstrated that integrating real-time data visibility and dispatch coordination can slash losses and dramatically improve reliability.

For the United African Defence Force, ASDT's proposed continental security division being established at The Sandton Symposium 2025, OmniGaza provides a state-of-the-art command and control capability. The platform offers real-time monitoring of high-value assets, critical infrastructure, and supply chain movements. This allows for an intelligence-led, proactive security posture that is a generational leap beyond conventional static guards and perimeter fences. It enables the rapid detection of anomalies, the pre-emptive deployment of resources to mitigate threats, and a comprehensive understanding of the operational environment that is essential for protecting people, assets, and reputation in complex regions.

The true strategic advantage of OmniGaza emerges from this very integration. The value of the data it generates is far greater than the sum of its parts. A single data point—such as the precise real-time location of a haulage truck carrying processed minerals—holds simultaneous value for multiple stakeholders. The project manager uses it to verify a logistical milestone. The logistics planner uses it to adjust routing for the rest of the fleet. The security chief uses it to monitor a high-value convoy. In a traditional, fragmented system, these three actors would be operating on different, often incompatible, information systems, leading to delays and information gaps. By creating a single, shared, and trusted source of truth, OmniGaza enables a level of cross-divisional optimisation that was previously unimaginable. This creates compounding efficiencies across the ecosystem: superior logistics reduce operational costs, which improves project profitability; superior security reduces risk, which lowers insurance premiums and attracts more patient capital. This is the ultimate expression of the integrated ecosystem's power—a system where every part intelligently informs and strengthens the whole.

4. Engaging the Global Apex: Why ASDT’s Model Resonates with Premier Stakeholders

The architecture pioneered by Africa’s Sovereign Development Trust® is not merely an operational improvement; it is a strategic solution designed to meet the exacting and evolving demands of the world's most sophisticated financial and institutional actors. The model's inherent transparency, verifiability, and risk mitigation directly address the primary concerns of central banks seeking to secure their national reserves and global asset managers mandated to deliver both financial returns and demonstrable ESG performance. For these premier stakeholders, ASDT does not just offer a product; it offers a new standard of assurance.

4.1. A New Gold Standard for Sovereign Reserves

In recent years, the world's central banks have been acquiring gold at a historic pace. For three consecutive years, net purchases have exceeded 1,000 tonnes annually, a level of accumulation not seen in decades. This strategic shift is being led by emerging market economies, with the central banks of China, Poland, India, and Türkiye at the forefront. The drivers behind this "bullion bonanza" are clear and compelling. In an era of heightened geopolitical tension, economic uncertainty, and the strategic weaponisation of currencies, central banks are aggressively seeking to diversify their foreign exchange reserves away from an over-reliance on the US dollar. Gold is viewed as the ultimate safe-haven asset: a proven long-term store of value, an effective hedge against inflation and crisis, and, crucially, a reserve asset that carries no counterparty risk and is independent of any single government's policy decisions.

Central bankers are not simply purchasing a commodity; they are acquiring a form of geopolitical insurance. In this high-stakes context, the provenance and integrity of the gold they acquire is becoming an increasingly critical, if often unspoken, consideration. Gold sourced from regions plagued by conflict, tainted by human rights abuses, or extracted using environmentally destructive methods carries significant and growing reputational, ethical, and even legal risks for a sovereign entity. This is the precise challenge that the ASDT model is uniquely equipped to solve.

Through the OmniGaza platform, ASDT can offer its sovereign clients something no other producer on the continent can: an immutable, auditable, end-to-end record of its gold's journey. This is not a marketing claim but a verifiable data trail. A central bank can, through the platform, trace its bullion back to the specific mine of origin, verifying data on everything from labour conditions and safety protocols to water usage and land rehabilitation. This "verifiable provenance" fundamentally transforms the nature of the asset. It elevates ASDT's product from a simple commodity to a strategic reserve asset that is also fully compliant with the highest conceivable ethical, social, and environmental standards. For a central bank navigating the complexities of the 21st-century global order, this is "Gold Plus"—an asset that not only fulfills its primary financial purpose as a store of value but is also completely insulated from the ESG-related risks that are of increasing concern to global policymakers and the international community.

4.2. Meeting the Mandate of Global Capital: Delivering Verifiable ESG Performance

The world's largest institutional investors and asset managers, entities that command trillions of dollars in capital, are undergoing a profound transformation in their investment philosophy. Giants of the industry, including BlackRock and State Street, are no longer treating Environmental, Social, and Governance (ESG) factors as secondary considerations. Instead, they are systematically integrating stringent ESG criteria into the core of their investment and risk management processes, particularly when allocating capital to emerging markets. Their investment funds now actively screen out companies engaged in controversial activities such as the production of certain weapons or tobacco, and they increasingly assess potential investments based on sophisticated, data-driven analysis of factors like carbon emissions, water stress, labour practices, and corporate governance quality.

The primary challenge for these global capital allocators, especially in the context of Africa, is the poor quality and unreliability of ESG data. Most information is self-reported by companies, is difficult to independently verify, and lacks standardisation, creating a significant due diligence burden and undermining the credibility of ESG-labelled investments. This is the critical gap that ASDT's operational model is designed to fill.

The OmniGaza platform functions as the ultimate ESG reporting engine, providing the raw, immutable, real-time data that these institutions need to satisfy their rigorous mandates and fiduciary duties. When a BlackRock portfolio manager needs to verify labour standards at an ASDT mine, they do not need to rely on a third-party audit report; they can be granted permissioned access to time-stamped, geolocated data on worker hours, safety training completion, and incident reports. When a State Street analyst needs to assess the environmental impact of an ASDT farm, they can review a verifiable record of water consumption, fertiliser application, and carbon sequestration. This moves the entire practice of ESG investing beyond the realm of corporate sustainability reports and into the domain of granular, verifiable, and auditable proof of performance. For an entity like BlackRock or a member of the World Economic Forum, partnering with ASDT provides a powerful solution: it de-risks their African investments by replacing unverifiable claims with immutable data, and it establishes a new global benchmark for what true, data-backed ESG compliance looks like in practice.

Conclusion: The Future is Integrated, Transparent, and African-Led

The analysis presented in this report leads to an unequivocal conclusion. The chronic and deeply entrenched challenges that have long defined the narrative of African development—the catastrophic failures in logistics, the systemic financial exclusion of primary producers, the pervasive governance deficits in resource extraction, and the disheartening landscape of abandoned projects—are not a series of unrelated misfortunes. They are, in fact, symptoms of a single, foundational cause: the absence of a trusted, transparent, and integrated operational layer upon which sustainable economic activity can be built. For too long, value chains have been fragmented, processes have been opaque, and trust has been a scarce and fragile commodity.

Africa’s Sovereign Development Trust®, through its visionary architecture, has systematically engineered this missing layer. The model is not an incremental improvement on the old, broken systems; it is a fundamental re-architecting of how value is created, managed, secured, and distributed on the continent. By combining direct ownership of physical assets with the powerful technological backbone of the OmniGaza platform, ASDT has created a self-sustaining, high-trust ecosystem. Within this ecosystem, transparency is not a corporate promise but a programmable, verifiable, and immutable feature of the system itself. Accountability is not left to chance but is automated through smart contracts. Risk is not simply transferred but is mitigated and shared through inclusive, tokenized financing models.

This is a paradigm built less on politics and more on demonstrable action and verifiable results. It is a model that provides central banks with gold of unimpeachable provenance, and global investors with the auditable ESG data they demand. It empowers local stakeholders not as passive beneficiaries, but as active, vested partners in their own economic destiny. ASDT has moved beyond the rhetoric of potential and is delivering the tangible infrastructure of progress. For any global institution, investor, or government serious about partnering in a visible, reliable, and prosperous future for the African continent, the path forward is clear. The future is integrated, it is transparent, and it is being decisively led from within Africa. ASDT is not just participating in that future; it is building its very foundation.